Master Strategies

- Know relationship between us and our money. It is our money that should work for us and not us working for it all our lives

- Pursue ownership of income-producing assets e.g. shares in dividend paying companies

- Use the stock market to put money to work for us, and

- Indoctrinate present and future family members in the mindset of always being wealthy on a revolving basis

Note #1

This is not necessarily an easy option for most employees, but it can be done if the mindset of ownership of income-generating asset is incorporated into the Family culture.

Note #2

You are invited.

This is a Self-Improvement website. Be bold. Make the decision now to start building your own wealth. Let future generations in your Family Tree recognize you as the person who started the wealth-building tradition. It is possible!

The Big Picture

To enable more families, from more countries, to use the strategies of Inter-Generational wealth creation, through the stock market, to create more wealth, for more family members, on a revolving basis. This means changing more minds from 'working for money' to 'putting money to work' for oneself; becoming shareholders, and thus part owners, of dividend paying companies whose products and services we use; and, as dividend receivers, learning how to re-invest all , or some of it, to grow our share count, so that, over time, we increase the value of our investment by relying on the wealth-building powers of compounding, and time, (as measured in decades) even if we did not add any more money from our pocket.… (more)

In this inter-generational wealth-building model,

- They ‘compound’ the investment by re-investing all dividends while the children are growing up

- Great grandparents, grandparents, and parents, buy shares for their great grands, grands, and own children in outstanding dividend paying companies

- Use the accumulated funds for educational, business pursuits, or just to accumulate wealth for themselves

- Build endowments for retirement income

- Enjoin beneficiary children to repeat the wealth-building process when they become parents and grandparents and keep "selling" the concept ‘down the line’ from one generation to the next.

Five Advantages of this inter-generational wealth building model

- It puts your money to work for you within a long-term framework

- Your investment gets the growth promotional benefits of the two most profound growth enhancers in the world i.e., Compounding and Time (as measured in the decades of your life)

- Your investment is managed by people who are incentivized to get the best value outcomes

- You are left free to pursue your own career while your money does all the work for you

- Due to the long-term investment framework, you can sleep well at nights!

To Sumarize

Nothing in life is easy anymore but, with a little effort on our part, and some corporate incentives, I believe that more people, in more places, could find more resources to improve the quality of their lives.

The effort that is needed is for more individuals to accept, and own, the responsibility for their own, and their family's financial welfare. When more people do, it will be easier for them to see, and embrace, the 'open secrets' of wealth creation 'hidden' in the twin concepts of compounding and time (as measured in decades)

The incentive to them, from the corporate side, is for the Registrars and administrators of stock markets across the world to give all investors an easier opportunity to re-invest some of their dividends, grow their share count painlessly and thus, almost without effort, enrich themselves and their dependents.

About the book

The stock market is one of man’s best innovations and is uniquely positioned to deliver on the promise of my book. This promise, is to build wealth on an inter-generational basis and thus enable more individuals, in more places, from one generation to the next, to enjoy a better standard of living.

Enough Wealth For Everyone

The world is full of a lot of wealth. The billionaires and one-percenters knew it all along. Its now the turn of everyone else… (more)

The Secret

It is sometimes said that the secrets of wealth creation are ‘hidden in plain sight’. The billionaires have long found this hidden secret… (more)

Its For Everyone

The book appeals to everyone, anywhere, and everywhere, who wants to build wealth for themselves… (more)

Get to know the author

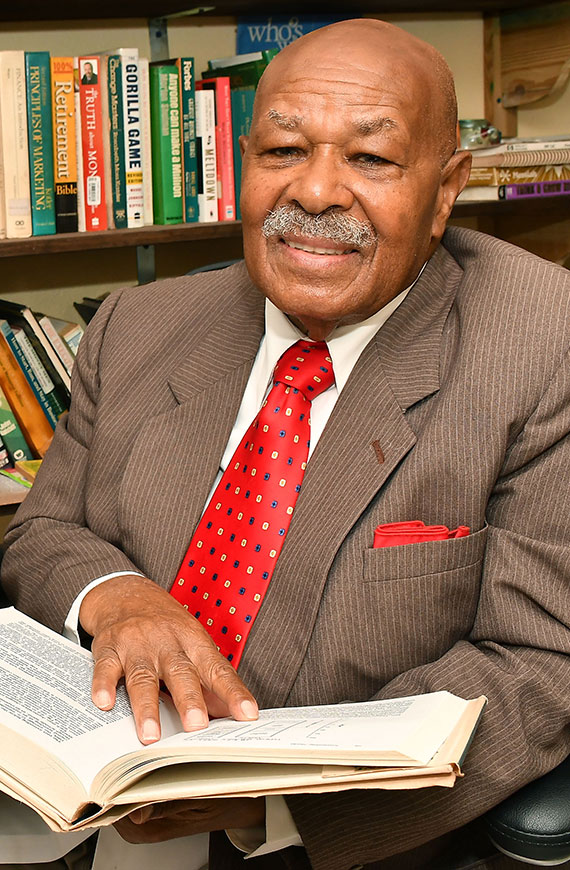

About Lloyd A. Vermont Sr.

Self-Taught-Dividend-Centric-Buy & Compound Investor. Pro bono Investment Advisor to extended Family. Over 30-year period, Mentor to 19 Young Investors, for each of whom he opened an individual stock market Account for purpose of them experiencing how Compounding & Time (as measured in decade) transform small investments into substantial amounts.

The idea is for them to use the experience as their own introduction to the wealth-building power of the stock market and to use this knowledge to start building wealth for themselves. Thinks every wage earner and consumer, from the equator to the north and south poles, should be a dividend earner too, by investing in at least one of the many dividend paying companies whose product or service is used by Everybody, Everywhere, Everyday (His 3E-Product Finder). Supports the assertion of Wharton School of Business (University-of Pennsylvania) Prof Jeremy J Siegel who said in his book "Stocks for the Long Run" that "Winning with stocks requires only patience, not foresight" Believes that, while long term stock market investing is not as easy as sleeping late on a rainy Sunday morning, neither is it much more difficult… (more)

References

Within the lifetime of most investors, and within the period in which their parents could have acted for nearly all of them, there were available scores of opportunities to lay the groundwork for substantial fortunes for oneself or one's children.

Common Stocks and Uncommon Profits.

Philip A Fisher — widely respected and admired as one of the most influential investors of all time

I am not delivered into thus world in defeat, nor does failure course in my veins. I am not a sheep waiting to be prodded by my shepherd. I am a lion and I refuse to talk, to walk, to sleep with the sheep. The slaughterhouse of failure is not my destiny. I will persist until I succeed.

From The Greatest Salesman in the World.

Og Mandino — Author

Twenty years in this business convinces me that any normal person using the customary 3% of the brain can pick stocks just as well, if not better, than the average Wall Street expert. All the math you need in the stock market... you get in the fourth grade.

From One Up on Wall Street.

Peter Lynch — Fund Manager

Get a copy

This book demystifies the stock market by explaining away the fear and distrust, then take it (market) to its readers as a credible platform on which to put money to work while they sleep well at night (and pursue their own careers).