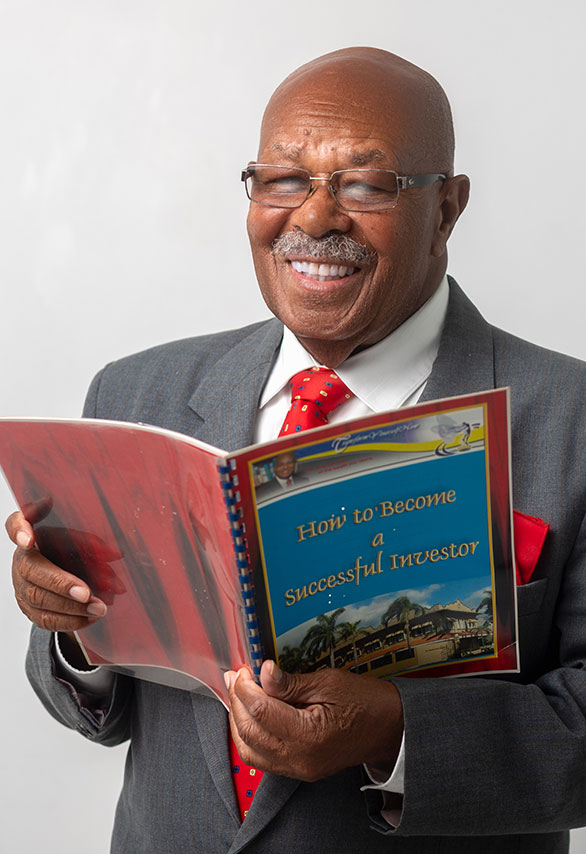

Lloyd A Vermont Senior FJIM**

Self-Taught-Dividend-Centric and Compound Investor

Mr. Vermont feels that every employee should own a little piece of his/her national economy and advocates that this can be done, by buying even a few shares in what he calls the ‘commanding heights’ (dominating corporate enterprises) of that economy. He knows that this is not necessarily an easy option for most employees, but believe it could be done if what passes as our ‘education’ system incorporates a little financial literacy.

He grew up on wrong side of the wealth tract. Voracious reader. Theorized that successful living was not a gift from heaven but predicated on the acceptance, and implementation, of what he calls free Developmental & Empowering Concepts. Those who accept and employ them, multiply their prospects of becoming successful. Those who neglect them, virtually pre-select themselves for remaining financially poor and dependent.

Saw the stock market as manifestation of one of the Developmental & Empowering Concepts for creating wealth for individuals & families.

He is the 1st to let you know that he is not one of the experts whom he studies. Instead, his conviction, and focus, is that the rest of us can, and should benefit, from their research, insight, and recommendations. Accordingly, he lives by three assertions and invites his readers to copy the same, or other experts, and build their own success-strategies.

First, the way to build individual and family wealth is not by man at work for money but, instead, the reverse, that is, money at work for man.

Second, the stock market, one of man’s best innovations, is an ideal platform through which every wage earner, and consumer, can put money to work, collect quarterly dividends, and grow wealth on an Inter-Generational basis while sleeping well at nights.

Third every wage earner and consumer, from the equator to the north and south poles can, and should, be a dividend earner too. This is because, many of the world’s best dividend payers are already ‘permanent residents’ in the homes of nearly Everyone, Everywhere, because, we use their products, and or services, in one way or another, Everyday.

He is pro bono Investment Advisor to his extended Family, friends, and acquaintances. Over 40-year period, Mentor to 31 Young Investors, to each of whom he gave their own Stock Market Account for the purpose of experiencing how Compounding (dividend re-investing) & Time (as measured in decades) transform even small investments into substantial amounts, such as one with Compound Annual Growth Rate (CAGR) of 40.09% over 16 years.

Mr. Vermont is one of the Thought Leaders on the Market Research Committee of the Jamaica Stock Exchange, heralded by Bloomberg LP as the best performing market in the world in 2015 and 2018. This is not a paid position.

He used his dividend re-investing strategy (compounding) to lift himself from nothing to something. Now he wants everyone who follows his commentary on the subject to do the same for him or herself. While there are individual companies that use dividend-re-investing plans (DRIP) to enrich their own shareholders, he is of the view that, if registrars and transfer agents in dominant markets could be persuaded to do the same thing for their multitude of investor/shareholders, it would transform the wealth creation process, and enrich the lives of countless families on an inter-generational basis. The Book on which he is working [The Stock Market: Route to Inter-Generational Wealth (For those who want to build some but feel intimidated)] uses well-known companies from the American and Jamaican stock markets to illustrate and support his three assertions.

** Fellow, Jamaican Institute of Management